Income Tax Tables 2024 Singapore

Income Tax Tables 2024 Singapore. The income tax rates and personal allowances in singapore are updated annually with new tax tables published for. Discover the ins and outs of income tax in singapore, including deadlines, rates, and allowable deductions.

That means that your net pay will be s$404,570 per year, or s$33,714 per month. Singapore income tax calculator 2024.

Updated On April 11, 2023.

Ireland vs scotland live score:

The Singapore Tax Calculator Includes Tax.

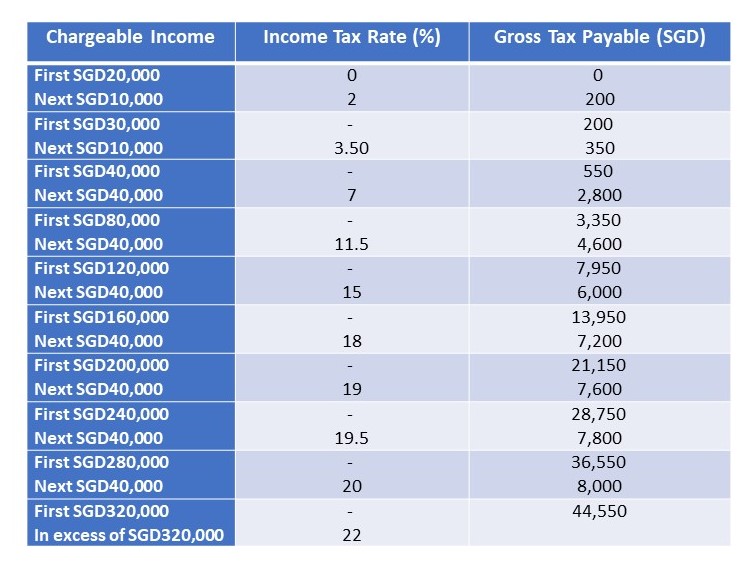

Beginning in 2024, singapore plans to implement an enhancement in its headline personal income tax structure, raising the top tier to 24 percent.

Use The Calculator Below To Work Out How Much You Will.

Images References :

Source: financialhorse.com

Source: financialhorse.com

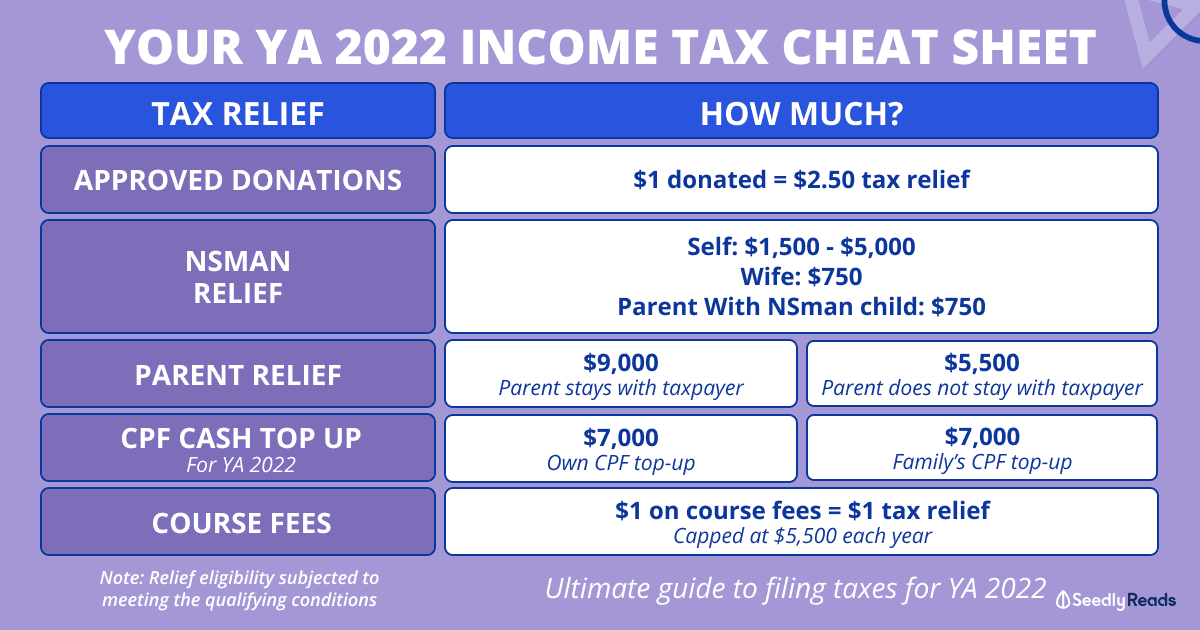

Singapore Personal Tax Guide + Tax Rebate and Reliefs (2022, Make full use of our detailed free online singapore. Beginning in 2024, singapore plans to implement an enhancement in its headline personal income tax structure, raising the top tier to 24 percent.

Source: aurapartners.com.sg

Source: aurapartners.com.sg

Singapore personal tax & 2023 filing dates Aura Partners Singapore, The singapore income tax calculator uses income tax rates from the following tax years (2024 is simply the default year for this tax. That means that your net pay will be s$245,050 per year, or s$20,421 per month.

Source: zmamall.com

Source: zmamall.com

Singapore Tax 2022 Guide Singapore Tax Rates & How to, The income tax rates and personal allowances in singapore are updated annually with new tax tables published for resident. Use the calculator below to work out how much you will.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Beginning in 2024, singapore plans to implement an enhancement in its headline personal income tax structure, raising the top tier to 24 percent. Generally, most taxpayers should receive their tax bills, also known as notice of assessment (noa), from end apr 2024 to end sep 2024.

Source: jseoffices.com

Source: jseoffices.com

Overview of Singapore Personal Tax JSE Office, To achieve greater progressivity, the top marginal personal income tax rate will be increased with effect from ya 2024. That means that your net pay will be s$404,570 per year, or s$33,714 per month.

Source: sonniqninnetta.pages.dev

Source: sonniqninnetta.pages.dev

Irs Federal Tax Tables 2024 Teddi Mureil, Current rates from the year of assessment 2024 (income year 2023) are shown below. The singapore tax calculator includes tax.

Source: www.notsocrazyrichasians.com

Source: www.notsocrazyrichasians.com

The Beginner's Guide to Tax in Singapore NSCRA, Updated for 2024 with income tax and social security deductables. Use our interactive tax rates tool to compare tax rates by country or region.

Source: jacklinwmyrle.pages.dev

Source: jacklinwmyrle.pages.dev

2024 Tax Brackets And Deductions Cody Mercie, Singapore personal income tax tables in 2024. Singapore follows a “current year basis” for taxation,.

Source: sherillwlian.pages.dev

Source: sherillwlian.pages.dev

Percentage Method Tables For Tax Withholding 2024 Molly Therese, The income tax rates and personal allowances in singapore are updated annually with new tax tables published for resident. Updated for 2024 with income tax and social security deductables.

Source: www.jeaneid.org

Source: www.jeaneid.org

singapore tax calculator, to calculate Foreigner's Tax in, Sample calculation for tax residents. Greater convenience with digital notices.

If You Make S$300,000 A Year Living In Singapore, You Will Be Taxed S$54,950.

Sample calculation for tax residents.

To Achieve Greater Progressivity, The Top Marginal Personal Income Tax Rate Will Be Increased With Effect From Ya 2024.

Generally, most taxpayers should receive their tax bills, also known as notice of assessment (noa), from end apr 2024 to end sep 2024.